Need help with your Corporate Compliance Issues?

-

+91-94636 40466

Speak with an Attorney!

Fill Up the below Mentioned Form

Speak with an Attorney!

In the ever-evolving landscape of corporate law, businesses need expert guidance to navigate the complexities of compliance and governance. Adhering to the comprehensive requirements of the Companies Act 2013, including director appointments, shareholder meetings and other regulatory obligations is crucial but can often seem overwhelming.

That’s where M/s Lal Ghai & Associates steps in. As a distinguished firm of Company Secretaries, we offer a full spectrum of professional services designed to ensure seamless corporate functioning and regulatory adherence. From company incorporation to corporate governance, secretarial audits and compliance management, we provide tailored solutions that help businesses operate smoothly, ethically, and within the legal framework.

With our expertise, proactive approach, and client-centric solutions, we empower businesses to focus on their growth while we handle the complexities of corporate law.

Setting up a business? We help you register and structure your company seamlessly:

✔ Private & Public Companies

✔ One Person Company (OPC)

✔ Producer & Nidhi Companies

✔ NBFC, Insurance & RBI-Regulated Companies

✔ Section 8 (Non-Profit) & Government Companies

✔ Limited Liability Partnerships (LLP)

Corporate Governance & Compliance

Governance isn’t just about rules—it’s about building trust. We assist in:

✔Strengthening corporate governance frameworks

✔ Ensuring ethical and transparent decision-making

✔ Advising on directors’ duties and liabilities

Board and Shareholder Meetings

From planning to execution, we ensure seamless board and shareholder meetings, including agenda preparation, resolutions, and statutory record maintenance.

Regulatory Compliances

With ever-changing laws, staying compliant is crucial. We offer comprehensive compliance solutions for:

✔ Companies Act, 2013

✔ SEBI Regulations

✔ RBI & FEMA Guidelines

✔ Industry-Specific Laws

Directors’ Duties and Liabilities

We help Directors and Key Managerial Personnel (KMPs) understand their roles, responsibilities, and liabilities to ensure compliance and mitigate legal risks. Our services include:

✔ Fiduciary Duties & Ethical Governance

✔ Compliance with Companies Act, 2013

✔ Risk & Liability Management

✔ Board Responsibilities & Decision-Making

✔ Corporate Social Responsibility (CSR) Compliance

✔ Training & Awareness Program

Secretarial Audit

Secretarial Audit is a crucial compliance mechanism that helps companies ensure adherence to corporate laws, regulatory frameworks, and governance standards. At M/s Lal Ghai & Associates, we conduct thorough secretarial audits to identify legal gaps, mitigate risks, and enhance corporate transparency.

✔ Compliance Check – Reviewing adherence to the Companies Act, 2013, SEBI Regulations, FEMA, RBI Guidelines, and other applicable laws.

✔ Risk Identification & Mitigation – Detecting non-compliance issues and providing corrective solutions.

✔ Verification of Corporate Records – Ensuring proper maintenance of statutory registers, board resolutions, and shareholder records.

✔ Audit Reports & Recommendations – Preparing detailed audit reports with actionable insights for improved governance.

✔ Regulatory & Compliance Advisory – Assisting in rectifying non-compliance to prevent penalties and legal complications.

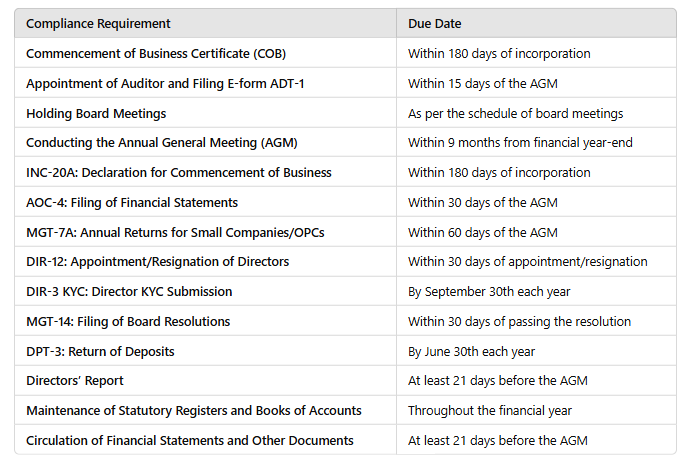

Annual Compliance Calendar for Private Limited Companies

A private limited company must comply with several annual requirements, including:

Non-compliance can lead to:

Yes, every private limited company must appoint a statutory auditor within 30 days of incorporation. The auditor is responsible for auditing financial statements and ensuring compliance with the Companies Act, 2013. Failure to appoint an auditor may result in penalties for the company and its officers.

After incorporation, a company must:

Yes, a director can be disqualified under Section 164 of the Companies Act, 2013, for reasons such as: