If you’re planning to start a trust in India, it’s essential to understand the different types of trust registrations available. Trusts play a critical role in managing family wealth, estate planning, and fulfilling charitable or religious goals. This article offers a comprehensive, updated overview of how many types of trust registrations there are in India, their benefits, legal framework, and the registration process.

What Is a Trust?

A trust is a legal entity where a settlor transfers assets to a trustee to manage them for the benefit of beneficiaries. The purpose can be either private (family benefit) or public (charity, religion, etc.).

Types of Trust Registrations in India

There are two major types of trusts in India:

Private Trust

A Private Trust is formed for the benefit of individuals or families.

Governing Law: Indian Trusts Act, 1882

Key Features:

- Specific and known beneficiaries

- Commonly used for estate planning and wealth management

- Can be revocable or irrevocable

Types of Private Trusts:

- Discretionary Trust: Trustee has discretion in distributing assets

- Non-Discretionary Trust: Follows fixed terms

- Revocable Trust: Can be modified

- Irrevocable Trust: Cannot be changed once created

Public Trust

A Public Trust is created for the benefit of the general public or a section of society.

Governing Law: State-specific laws like Maharashtra Public Trust Act, Tamil Nadu Hindu Endowments Act, or the Indian Trusts Act (where applicable)

Key Features:

- Aimed at charitable, religious, or social welfare purposes

- Can apply for 12A and 80G income tax exemptions

- Mandatory to use funds for the trust’s stated objectives

Types of Public Trusts:

- Charitable Trusts

- Religious Trusts

- Charitable-cum-Religious Trusts

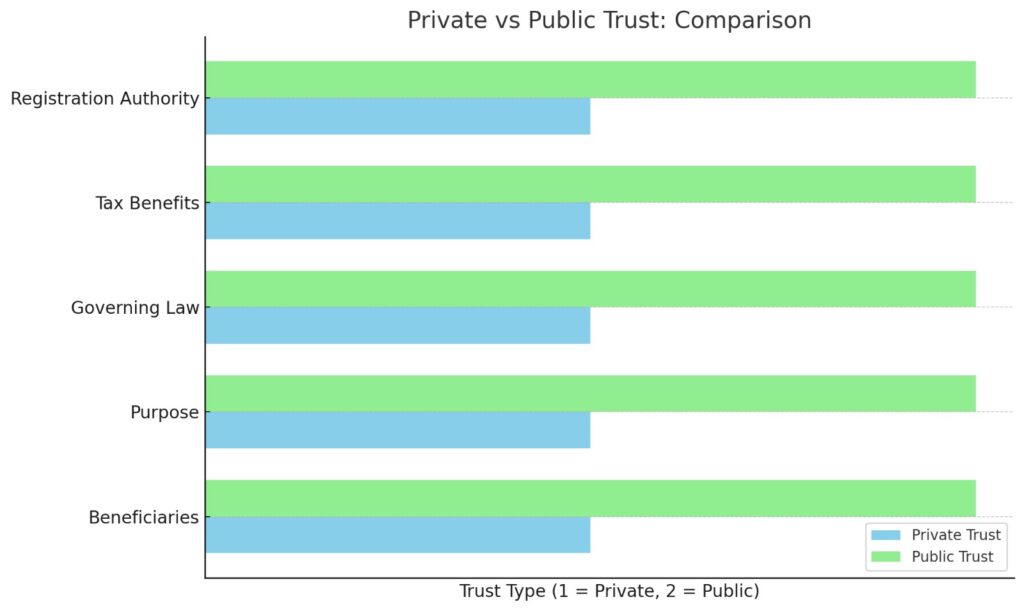

Private vs Public Trust: Comparison

Trust Registration Process in India

Here’s a step-by-step breakdown:

Step 1: Draft the Trust Deed

Must include:

- Trust name & objectives

- Settlor and trustee details

- Beneficiaries and property details

- Roles, rules, and asset usage

Step 2: Choose a Unique Trust Name

Ensure it’s not restricted under the Emblems & Names Act.

Step 3: Prepare Required Documents

- Non-judicial stamp paper (as per state)

- ID proofs (PAN, Aadhaar)

- Photographs

- Registered office proof & NOC

Step 4: Apply for Registration

- Submit the deed to the Sub-Registrar (private) or Charity Commissioner (public).

Step 5: Receive Registration Certificate

This gives your trust legal identity.

Benefits of Trust Registration in India

- ✅ Legal recognition & protection

- ✅ Tax exemption (for public trusts)

- ✅ Succession & estate planning

- ✅ Access to CSR funding and government grants

- ✅ Eligible for FCRA registration (foreign donations)

Why Choose Lal Ghai & Associates?

At Lal Ghai & Associates, we simplify the trust registration process in India. Whether you’re forming a charitable trust or a private family trust, we provide:

- Trust deed drafting

- Legal consultation

- Name verification

- PAN, TAN, 12A/80G registration

- FCRA advisory

- Ongoing compliance & filing

Conclusion

Understanding how many types of trust registrations there are in India is the first step towards creating a compliant and impactful trust. Whether you’re planning to establish a family trust or serve a social cause, proper registration ensures legitimacy, transparency, and access to tax & legal benefits.

Need help registering a trust in India?

Contact Lal Ghai & Associates today for expert legal support and complete documentation services.

📞 Contact: 94636-40466

🌐 Website: www.lgassociates.org

📍 Offices: Ludhiana | Mohali | Gurugram