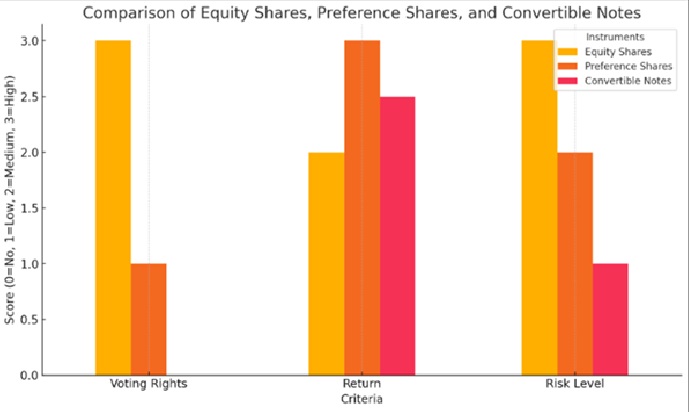

When it comes to fundraising for startups or corporate capital structuring, businesses have multiple instruments at their disposal. Among the most widely used are equity shares, preference shares, and convertible notes. Each of these instruments plays a unique role in financing, investor rights, and company control. Understanding the difference between them is crucial for startup founders, angel investors, and financial advisors.

In this article by Lal Ghai & Associates, we break down the definitions, features, legal framework, and strategic advantages of these three funding options in the Indian context.

What Are Equity Shares?

Equity shares, also known as ordinary or common shares, represent ownership in a company. Equity shareholders are entitled to voting rights and a share in the company’s profits through dividends and capital appreciation.

Key Features:

- Ownership & Voting Rights: Shareholders have control over major decisions.

- Dividend: Variable and declared at the discretion of the Board.

- Risk & Reward: High potential return but last claim in case of liquidation.

- Best For: Public offerings, long-term investors, ESOPs.

What Are Preference Shares?

Preference shares are a hybrid between equity and debt. Investors receive a fixed dividend and have priority over equity shareholders during liquidation but usually lack voting rights.

Key Features:

- Fixed Returns: Guaranteed dividend payout.

- Priority in Claims: Second only to debt holders during liquidation.

- Convertible Options: Can be structured as convertible or redeemable.

- Best For: Venture capital, strategic investments.

What Are Convertible Notes?

Convertible notes are debt instruments that convert into equity at a later stage—usually during a qualified funding round. These are particularly popular among early-stage startups.

Key Features:

- Debt Now, Equity Later: Carry interest, later convert to equity.

- Valuation Flexibility: Suitable for startups with uncertain valuation.

- Discounts and Valuation Caps: Protect early investors.

- Best For: Angel investors, seed funding rounds.

Comparative Table: Quick Snapshot

Legal Framework in India

- Equity & Preference Shares: Governed by the Companies Act, 2013 and SEBI for listed companies.

- Convertible Notes: Allowed for DPIIT-recognized startups. Minimum investment ₹25 lakhs from foreign investors. Must convert within 5 years.

Compliances include Shareholders’ Agreement (SHA), Convertible Note Agreements, and ROC filings under Companies Act Sections 55 & 62.

Which One Should You Choose?

- Startups: Go for convertible notes for fast, flexible fundraising.

- Growth-Stage Companies: Use preference shares for risk-adjusted strategic funding.

- Public Companies or Long-Term Players: Issue equity shares for broader investor participation.

Final Thoughts

Choosing between equity shares, preference shares, and convertible notes depends on your company’s funding stage, risk appetite, and growth objectives. Each instrument brings different regulatory obligations, tax implications, and investor expectations.

At Lal Ghai & Associates, we help businesses choose the most compliant and strategic route for capital raising. From drafting share agreements to ensuring regulatory approvals, our expert legal team ensures you raise funds efficiently and legally.

📞 Contact us today for tailored legal solutions in startup funding, equity structuring, or convertible note issuance.