A Limited Liability Partnership (LLP) is a hybrid business structure that combines the flexibility of a traditional partnership with the benefits of limited liability, similar to a company. Governed by the Limited Liability Partnership Act, 2008, LLPs have become a preferred choice among startups, small businesses, and professionals in India. This guide covers the latest updates, registration process, benefits, and compliance requirements for LLPs, along with expert assistance from trademark registration consultants in Ludhiana like Lal Ghai & Associates.

What is a Limited Liability Partnership (LLP)?

An LLP is a separate legal entity that offers limited liability to its partners, ensuring their personal assets are protected in case of business losses. Unlike a sole proprietorship, LLPs allow multiple partners to collaborate with less compliance burden than a private limited company.

Key Features of an LLP:

- Separate Legal Entity: LLPs can own assets, sue, or be sued under their name.

- Limited Liability Protection: Personal assets of partners remain secure.

- Perpetual Succession: LLPs continue to exist even if partners change.

- Flexible Structure: Fewer regulatory compliances compared to companies.

- No Minimum Capital Requirement: LLPs can be formed with minimal financial investment.

Advantages of LLP Registration in India

- Legal Protection: LLPs offer limited liability to protect partners’ assets.

- Tax Benefits: LLPs enjoy tax advantages over private limited companies.

- Ease of Registration: Simple and cost-effective registration process.

- Less Compliance: Compared to a private limited company, LLPs have fewer annual filings.

- Better Credibility: LLPs have a better reputation compared to unregistered partnerships.

Step-by-Step Guide to LLP Registration in India

1. Obtain a Digital Signature Certificate (DSC)

Partners must obtain a DSC from authorized certifying agencies to digitally sign documents required for LLP registration.

2. Apply for a Designated Partner Identification Number (DPIN)

Partners need to obtain a DPIN via Form DIR-3, which is submitted with proof of identity and address.

3. Name Reservation via MCA (RUN-LLP Service)

Applicants must select a unique LLP name through the Reserve Unique Name (RUN-LLP) service on the MCA portal.

4. File Incorporation Form (FiLLiP)

The incorporation application FiLLiP must be filed with the Ministry of Corporate Affairs (MCA), including:

- Registered office details

- Partners’ details

- Subscription form

- Address proof

5. Draft and File the LLP Agreement

Once the incorporation is approved, partners must draft an LLP Agreement outlining rights, duties, and responsibilities. This is filed using Form 3 within 30 days of incorporation.

6. Apply for PAN & TAN

To ensure tax compliance, LLPs must apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) from the Income Tax Department.

7. Receive the Certificate of Incorporation

After completing all steps, the Registrar of Companies (RoC) issues a Certificate of Incorporation, legally recognizing the LLP.

Recent Trends in LLP Registrations in India

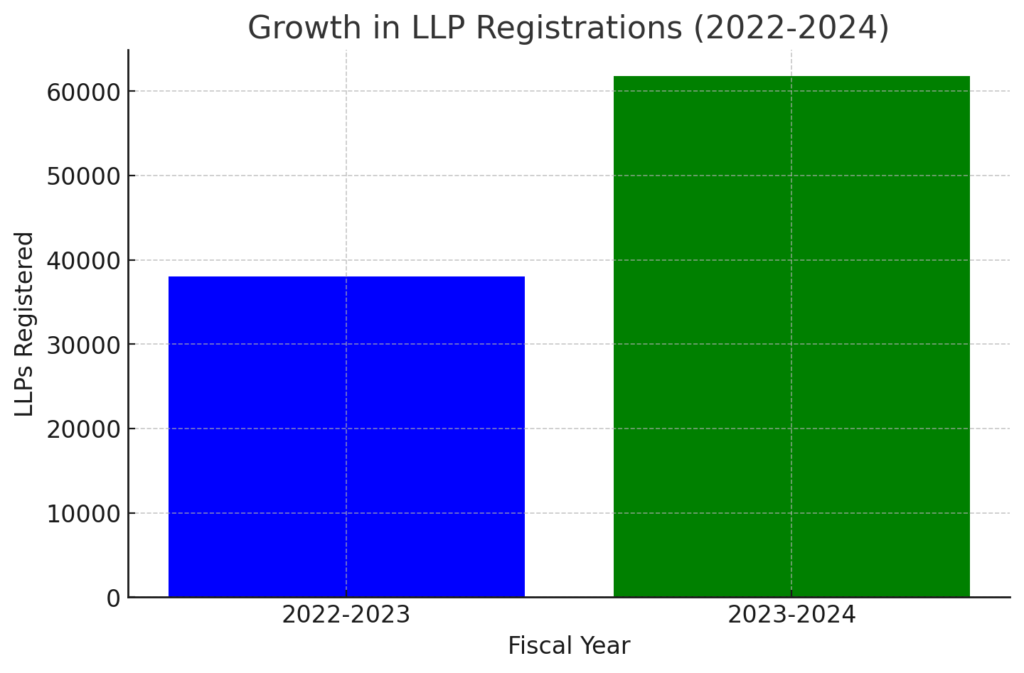

LLP formations have witnessed significant growth in India due to their flexibility and legal protection.

Did You Know? As of February 21, 2025, India registered 449 LLPs in a single day, highlighting the increasing adoption of LLPs.

LLP Compliance Requirements in India

- Annual Return Filing (Form 11) – Must be filed within 60 days of the financial year’s end.

- Statement of Accounts (Form 8) – To be filed within 30 days from six months after the financial year’s closure.

- Income Tax Filing – LLPs must file their annual tax returns.

- Audit Requirement – LLPs with a turnover exceeding ₹40 lakh or contributions over ₹25 lakh require mandatory auditing.

Conclusion

Registering an LLP in India provides business flexibility, tax advantages, and legal protection, making it an ideal choice for startups and SMEs. With its simple compliance structure and cost-effectiveness, LLPs continue to grow in popularity.

For expert LLP registration services, trademark registration, and legal compliance, consult Lal Ghai & Associates – Leading Trademark Registration Consultants in Ludhiana. Contact us today to ensure a seamless and legally compliant LLP incorporation process.

Get in touch with us today!

📍 Branches: Ludhiana | Mohali | Gurugram

📞 Call Us: +91 94636 40466

🌐 Website: www.lgassociates.org